So You Want to Buy a Laundromat?

Turns out, kids these days don’t want to be astronauts. They just want passive income in the form of quarters. If you too got a thing for coins and want to own a laundromat, how much cash will you need?

Obnoxious answer: it depends.

Here’s the range, we’ve bought a laundromat for $100,000 that netted $67,000 a year, and another for $1.5 million that nets more like $300,000 a year. A laundromat can cost anywhere between $50,000 to over $4 million. The reason is that laundromats fall into a category we call high on the:

Passive + inexpensive + simple scale

Which is part of the reason we generally like investing in them.

How Much Is It to Buy a Laundromat?

Good rule of thumb: 2-5x the profit of the laundromat. That’s it. That’s the price.

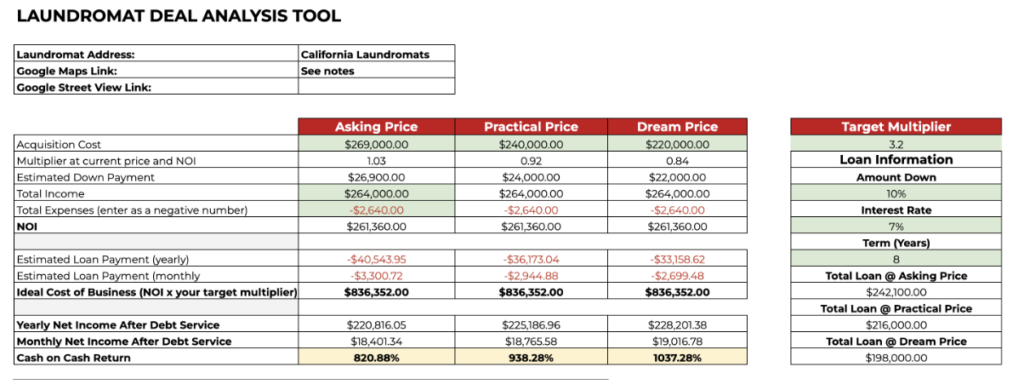

So if a laundromat makes $100,000 a year, it is worth about $200,000 to $500,000. Period. But if you want to get fancy you can use our laundromat deal calculator:

Fast tips:

• There are two areas that account for 80% of your expenses in laundromats: your lease and your electricity. Check the water + energy bill and your lease and you’ll have 80% of your expenses down.

• You need a long lease with laundromats (5-10+ years) they’re expensive to build out so you don’t want to have to move.

• Traditional banks and the SBA don’t like to finance laundromats, err towards private investors or seller financing.

Why do We Like Buying Laundromats?

There are seven main reasons we like to buy laundromats (when the deal is right).

- The Customers Do the Work

Simple, easily understandable business. The customers do most of the work. They bring their own clothes, bring their own supplies, wash, dry and fold the clothes, and take their finished product out themselves. - Little Labor Costs

If the customer’s doing most of the work, that means there’s little need for extra labor, training, or onboarding costs in the laundromat business. You don’t need full-time staff — or really much staff at all. - Upfront Cash

One of the benefits of buying a Laundromat business is that the customers in the laundromat business pay you right away, which makes tracking your finances much easier. You don’t have to stress over complicated financial statements — you get all your coins in one spot. - Recession-Proof

No matter what happens, people always need clean clothes. This business won’t be as affected by downturns in the economy. - Great ROI

The laundry industry has a 20-35% average ROI and nearly a 95% success rate. This makes it a very advantageous investment compared to other riskier businesses. - Little Physical Inventory

Compared to something like a restaurant or retail store, laundromats have very little inventory that needs to be stored. This means fewer expenses for physical products and storage facilities. - Little Seasonality

People are (hopefully) always cleaning their clothes. The laundry business also is not as weather dependent. In the winter you might have jackets that are bigger but in the summer you’re getting a bit sweatier.

Pretty straightforward.

One Way to Get Other People To Pay For Your Purchase: Seller Financing

Yes, you can in fact buy a business with zero of your own money. It won’t work every time but it will work over time.

If you’d like to buy this laundromat above but you don’t have the capital, what do you do? Ask the seller to seller finance your deal. For you to use the pay from the future profits of the business to pay off the seller over time.

Why would a seller do that?

- It’s the way 60% of small business deals get done.

- It’s the only way to get a fast sale with you involved.

- The seller gets a better tax deal as it’s paid over time, not a lump sum.

- They get an annuity and you can even afford to pay a bit of a premium over time.

Before you become the great laundry negotiator, check out what we have to say about making great deals. You want to make things attractive for the seller and realistic for both of you.

Go get sudsy.

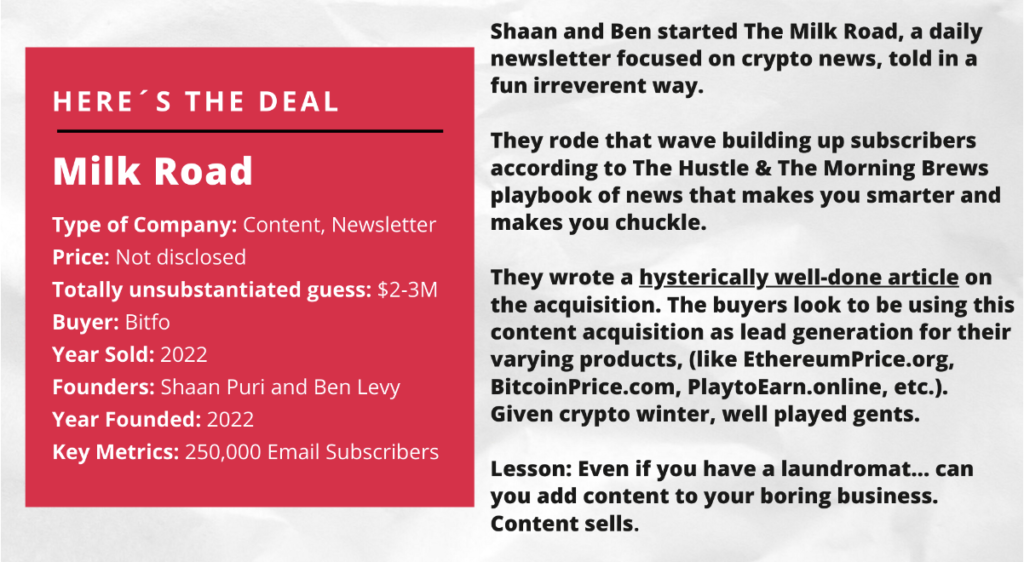

Deal of the Week: THE OPPOSITE OF A LAUNDROMAT.

This Week in Biz Buying:

– The SPAC spree is going to explode… and not in a good way. Watch out Chamath.

– Fujitsu going to $100 Million in international acquisitions.

– Fidelity makes first acquisition in 7 years buying a fintech co.

It’s deals like this that explain why I left Wall Street to invest in boring businesses.

Check out the video to see how I bought a laundromat with little down, which now makes me $67,000 a year in profit.

MAIN STREET > WALL STREET

-Unconventional Acquisitions Crew