We know, we know – it sounds too good to be true.

If it’s possible to buy an existing business with no money of your own… Then why doesn’t everyone do it?

The answer is pretty simple, actually: Most people aren’t motivated enough to do things the unconventional way.

The most popular method to buy a business with no money is seller financing, which we talked about a couple of weeks ago, and SBA loans.

Depending on the type of business you are buying, there are other unconventional way to finance purchasing a business to explore as well. Today, we’ll dive into some of those opportunities, in case you decide seller financing isn’t for you.

Benefits of buying an existing business

Being your own boss is the quintessential American dream. We can all admire the scrappy upstart who uses their passions to develop a business from the ground up, but that path isn’t for everyone.

Maybe you’re eager to own a business, but don’t want to have to sacrifice and scrape by until it’s off the ground. The sooner you can get profits rolling in, the sooner you can capitalize.

That’s what’s so brilliant about buying an existing business.

- You are getting an established business with systems in place that you can duplicate.

- You have a strong base of customers when you start.

- You can get guidance from the owners who built and ran it for years.

- Much of the tedious legal work has been done for you.

- The business may already have effective branding, a tried-and-true marketing strategy, and a roster of products and services.

- You become the owner of something with tons of potential – especially when you factor in all of the enthusiasm and motivation that you’ll bring to the table.

Sounds great, right? But maybe you don’t have the means to buy an established business. We all have to start somewhere, after all.

As crazy as it may sound, you don’t necessarily need cold, hard cash to acquire an established, income-generating business.

The savviest entrepreneurs often figure out ways to buy a business with no money down – and not just because they’re strapped for cash.

After all, why put your hard-earned money on the line for a business that could fail? Buying a business without forking over a dime is way less risky, and it’s more doable than you think. (It’s also not as risky if you follow our buying an existing business checklist)

Finding a business that’s right for you

If you’re trying to buy a business without paying any cash upfront, you need to target the right one. What’s the “right one,” you ask? Put simply, it’s one that’s owned by a highly motivated seller.

Picture this: Lydia has owned her business for 15 years and is approaching retirement age. She’s had the business on the market for several months with no bites. She has a lead on a great place in Florida, but she needs to unload the business quickly to make this happen.

Lydia is a prime example of a motivated seller. She wants out from under her business. She wants to ride out her golden years in comfort despite the profitability of her business. Sure, she’d love to get a cash offer. But given the circumstances, she’s also probably willing to negotiate an arrangement with the right buyer.

That buyer can be you.

Besides being up for sale with a motivated seller, the right business needs to be profitable. But it doesn’t have to be going like gangbusters to be worth your while.

In fact, an underperforming business is a good one to target because the owner, again, is probably very motivated to be rid of it.

With your fresh take on the situation, there’s no reason you can’t turn things around. You just need to find a way to acquire it without paying any cash.

So, how do you go about actually finding a biz for sale with a motivated owner and other promising characteristics?

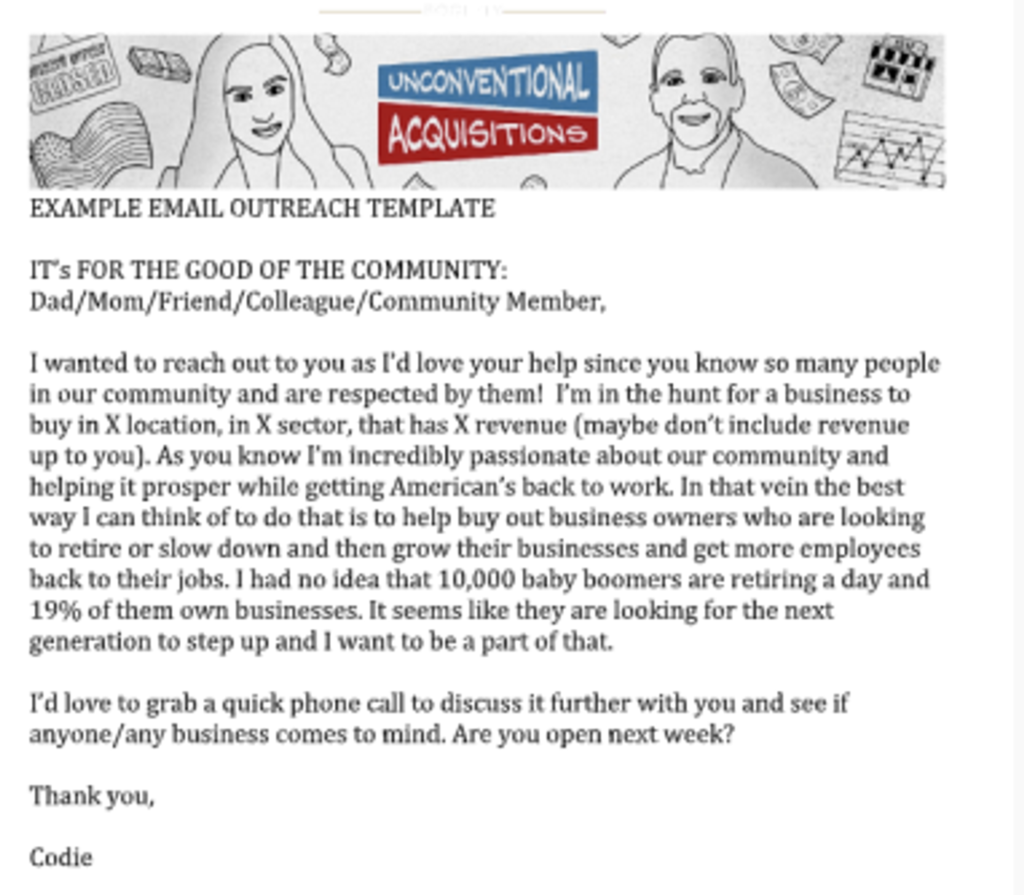

1. Email your people

Draft an email like the one below. Then go through your contacts and send it out individually to your top-tier people. It doesn’t hurt to also post it in a group to folks who might be able to help you find deals.

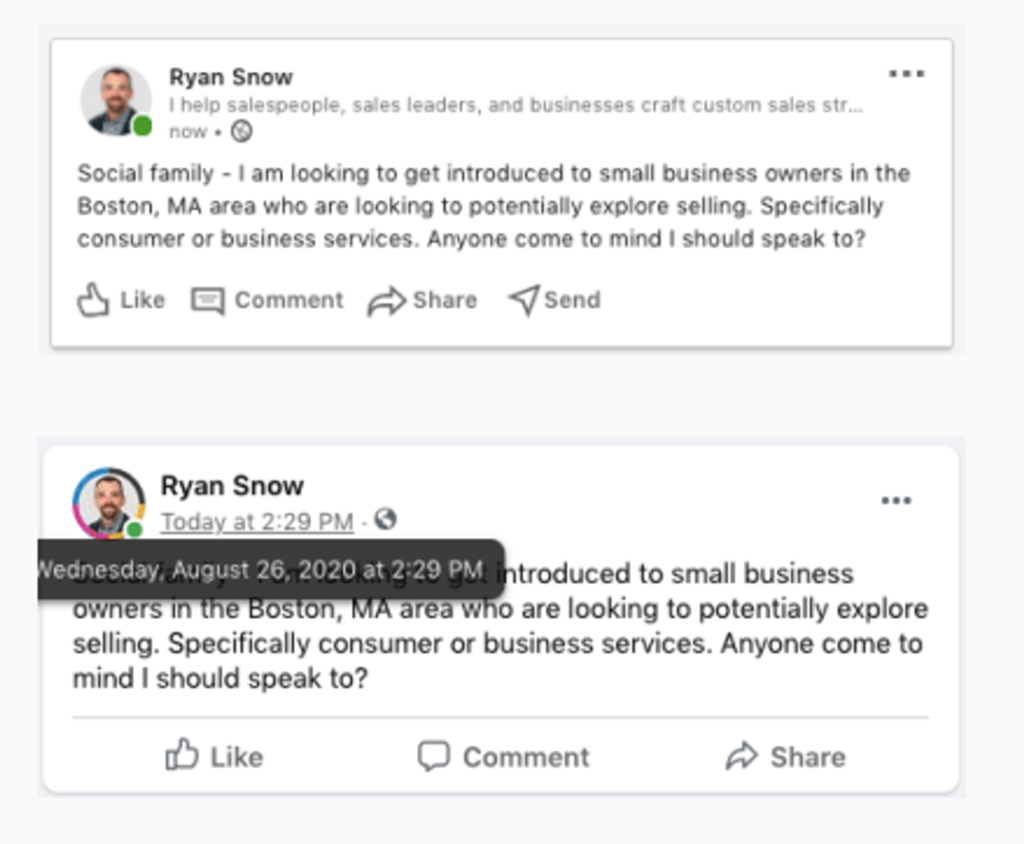

2. Leverage your social network

Tell everybody in your friend circle that you are looking to buy a business. So when they see someone in their community who is selling, you’re the first person that comes to mind.

Create a post like this:

3. Watch the business listings

More than likely, you’ll just have to put yourself out there and find what you need. An obvious starting point is to peruse online marketplaces like BizBuySell and Flippa. Check out our guide with a list of marketplaces where you can find great deals.

Spend a few days browsing these platforms and bookmarking the businesses you like.

4. Cozy up to local brokers

Brokers are always ahead of everything in this world of biz buying.

They are the first to know the deals before they go live on the marketplaces. In fact, many “good” businesses get sold without even being listed online. This is because the brokers have their own list of premium buyers—you need to be on that list.

5. Connect with a local business attorney or accountant

These professionals have their fingers on the pulse of the local biz community and can point you toward sellers who may be willing to work with you.

Keep in mind that no one is going to explicitly state that they’re willing to sell to non-cash buyers. So you’ll have to reach out to promising options yourself and feel them out.

Pro tip: Try contacting sellers whose businesses have been on the market for several months to a year.

Using an SBA loan to buy a business

Now that you have found a business to buy, you need funding. You may have heard of an organization named SBA (U.S. Small Business Administration), which mainly exists to help people like you purchase small businesses.

The beauty about SBA is they have relaxed requirements and usually have lower downpayments as compared to traditional banks. Their process is pretty straightforward, although it takes some time (30-60 days) for them to do the review process and give you the loan.

Say you got an SBA loan to cover 70% of the purchase price. Then you take an equipment loan to cover the rest.

In most cases, SBA and equipment loans together leave some good money on your hands even after paying the purchase price, which you can use to develop the business.

Other ways to buy a business with no cash

Seller financing isn’t the only game in town for buying an existing business without any of your own money.

For instance, it’s also possible to buy a business using its own cash. Known as a leveraged buyout, or LBO, this method involves acquiring a business using its assets and cash flow.

In a leveraged buyout, you leverage the company’s assets to finance your purchase of it. The one sticking point – and it can be significant – is that the business must be sold for a lower price than the value of its assets.

If a leveraged buyout isn’t in the cards, there are still plenty of ways to buy a company without money. Here are a few other ideas:

Pay-on-performance model

In this model, you and the seller establish performance benchmarks for the business. When these benchmarks are reached, you pay the seller an agreed-upon amount.

Benchmarks can be based on things like operating income, net income or revenues. The total paid amount is capped by a purchase price that you and the seller have outlined.

Shares only

You work for the business you want to buy and accept a reduced salary, and in exchange the owner gives you shares in the company—making you a part-owner. As you grow the biz and improve its profits, you can buy more shares until you are the primary owner.

Offer free services

Another option is to build sweat equity in the business you want to buy. Again, you offer to essentially work for free, handing over all profits to the owner until the financed amount is paid in full.

All of the above

You can also cobble together various methods to buy a business without paying any cash upfront. For example, you can use income-generating business assets to pay off the seller quickly. In addition, you could bring in a few additional silent partners to help you acquire the business and then buy them out later.

There’s always the option of applying for a business acquisition loan or a small business loan. However, such options usually involve forking over at least some money upfront.

This Week in Biz Buying:

Big Beauty is getting bigger with dozens of mergers so far this year.

Is Apple hoarding cash for a big media buyout? Maybe. Maybe not.

Uber CEO comes to shocking discovery: customers suck sometimes.

Don’t sleep on the structure of this Canadian sleep retailer buyout.

CVS is aiming to be the “entire spectrum of someone’s health journey.”